Barbara O’Neill, distinguished professor and extension specialist in Financial Resource Management.

During her sabbatical O’Neill, distinguished professor and extension specialist in Financial Resource Management, planned to research and curate an exhaustive list of online financial resources for her own purposes and did not initially plan to share them widely. Her work as an extension specialist, however, involves financial education and she has worked for years to help other financial educators—New Jersey teachers and military financial counselors—and pertinent stakeholders including students and seniors.

O’Neill came to realize the power of “Sabbatical-ing Out Loud,” as she labeled it, referring to the “Working Out Loud” (WOL) concept developed by John Stepper. WOL is a combination of doing high-quality observable work and narrating it via the Internet and social media so it is visible and beneficial to others.

As a result of SOL, her primary target audiences—those teachers and military financial counselors—have learned personal finance subject matter content and creative ways to present it.

To date, O’Neill has shared the results of her sabbatical project with hundreds of financial education professionals via social media, two webinars, at six professional conferences and through two blog posts—blogging being another skill she learned while on sabbatical.

Her Military Families Network blog post “What Financial Health Means to Me” was chosen as a winner by the Center for Financial Services Innovation (CFSI), netting her an invitation to the FinCon Expo in Dallas in October where out of more than 70 entries O’Neill’s was voted “one of the best.”

FinX Team Indigo left to right: Lacey Langford, Shaniqua Harrell, Barbara O’Neill.

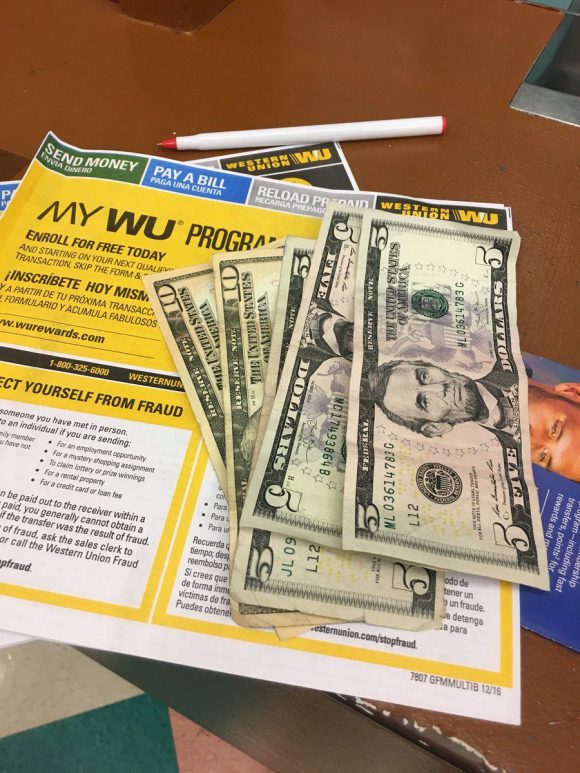

FinX-Western Union Check Cashing.

At FinCon, O’Neill participated in FinX, a real-time simulation, and was assigned to one of a number of teams that were given a multitude of tasks to accomplish in real time in the alternative financial services world of Dallas, TX. They had to try to cash checks, buy money orders, load prepaid cards, and more within a specific period of time. “It was literally like playing ‘The Apprentice,’” she remarked. “FinX provided invaluable insights into the financially and emotionally challenged lives of unbanked and underbanked Americans and the high cost of banking fees in the alternative financial services.”

To access O’Neill’s curated resources, visit her blog post “Resource Lists for Financial Educators” on the Next Gen Personal Finance website.